Financial Resolutions

Is one of your New Year’s resolutions to get on a better footing financially? Maybe to pay down debt or to save more. I used to focus on financial goals more than I do now but I think it’s time to change that. I want to be mindful of what we spend and how much we’re saving. Not only is the cost of everything rising and rising but the more money we can save each month, the closer we’ll be to reaching our retirement goal.

-Make a Plan

We’re going to get proactive with financial planning. We’re going to look at our budget every month and plan the next. The budget surplus will go into our savings account. I’m hoping that adjusting our focus each month to our progress will keep us motivated.

-Spend Less

Related to our first point, we’re going to try to spend less. Without being budget-conscious we’ve allowed ourselves, well me mostly, to spend more than we ought to have. I’ve bought far too much Starbucks and haven’t shopped sales as much as I could have. This year I’m going back to my roots and will be thinking through every purchase. Do I really need it? It is something that I could make do without? Could I buy a used version of it? I also want to figure out how to order Aldi pick up instead of the more expensive grocery pick up that I normally use. I want to buy cheaper brands whenever possible. I want to cook more at home instead of ordering take out. …and cheaper at home meals instead of whatever I’m feeling like at the moment. Planning meals and snacks in advance will help us save a good deal each month.

None of these things are huge in themselves but I think that if we can have the discipline to follow through then we’ll be able to easily save hundreds each month.

-Stay Motivated

It can be hard to stay excited about depriving yourself from fun frills, extra treats, entertainment, etc. Focusing on what we want to achieve instead of what we can’t have is essential to reaching our goals. I plan to read a lot of encouraging financial books and articles. The internet is full of people who have retired early, have paid off their loans, have found many ways to earn extra money, and many other ways to save money. I want to add financial books to my “to be read” pile and make it a point to read at least one financial article each week. Maybe I’ll share more about that here to keep us all motivated.

Did your family make any financial New Year’s Resolutions in 2024? If so please feel free to share them in comments.

The post Financial Resolutions appeared first on Embracing Homemaking.

Live With Less Declutter Challenge 2024 Printable

Here’s the printable coloring sheet/check list that I promised. Feel free to color a little portion when you let go of something until you have the sheet filled up.  You can let the sheet be the last thing you let go of. You can let the sheet be the last thing you let go of.

A few extra things to think about:

- You do not have to trash things…but you can. Feel free to give away, donate, or recycle anything you can. If you have so much and you just need to trash it that’s okay too.

- Trash doesn’t count. Well, if it has been in your house for a while then I guess it would count. New junk mail that comes in your house wouldn’t though. Does that make sense?

- If something is super sentimental but you think it’s time to let it go feel free to color a few spots for it.

- Feel free to post pictures of what you’re getting rid of in our Live With Less Facebook group.

Here’s the free printable I promised you and I hope you like it! My kids and I had fun creating it for you. I don’t think anyone would but please don’t sell this in any way. Feel free to print as many as you want for yourself and your family though.

Do you have any questions? How has the beginning of your decluttering challenge been?

The post Live With Less Declutter Challenge 2024 Printable appeared first on Embracing Homemaking.

Decluttering Challenge 2024

I haven’t written much on here in a good long while and I’m hoping this will be the first of many as I make my way back into posting regularly. (I share daily on Instagram if anyone wants to see a regular sneak peek into my life.) I’m glad you’re here and appreciate you taking the time to read what I share. I’m grateful for you and hope that you find something here that is good, true, and beautiful.

Are you feeling overwhelmed with stuff? It seems that no matter how much I donate and purge beforehand, my home feels overstuffed after each Christmas. I need this challenge for myself as much as I want to help encourage others! Let’s declutter together! I hope you’ll join me and participate in our great big decluttering challenge of 2024.

Actually, I want to propose two challenges. One for those who only want to devote a month, well 24 days to be exact, and the other for those who have a lot to let go of and want to declutter through the year.

The First Decluttering Challenge – 24 Bags in 24 Days!

Get rid of a bag a day for 24 days. Plastic bag, tote bag, a bag of bags, whatever.

The Second Decluttering Challenge – 2024 Items in 2024!

This challenge will be a bit more intense but this is the one I’ll be completing myself. It’s pretty straight forward, you get rid of 2,024 things during the year 2024.

FAQ

Q: Do I have to throw the things away.

A: Absolutely not! You can gift, donate, recycle, repurpose, or throw away. Try to let throwing away be your last option if possible. Be careful not to get stuck on wanting to repurpose or repair things though. It’s easy to save things for “one day” and that day never comes.

Q: How do you keep track of 2,024 things? Do we need to show photos of everything like in past challenges?

A: If you check back here on my blog on Friday I’ll have a free printable for both challenges. You can just color a little section for each item (or bag) you get rid of. They’re almost ready, I just have a few hundred sections to count.

Q: Will there be a cash prize this year?

A: No, there won’t be this year but maybe I’ll giveaway a smaller gift card to an active participant in our Facebook group. Joining our Live With Less Facebook group is a great way to gain inspiration and share your wins and struggles with people who get it.

Q: Is it okay if I post in the group daily?

A: Absolutely! To keep your progress organized you can post all of your pictures in the comments of your first post….or not. It could be fun to see all of the progress you’ve made this month/year in one place but you’re not obligated to. Just share away.

Q: Do you have a list of easy things to start with?

A: As it turns out, we do! Here’s our list of 200 Things to Let Go Of.

If you have any other questions please feel free to comment below and ask. I hope you’ll join us and invite a friend to join you too!

If you’re looking for some more Live With Less encouragement check out these resources (and don’t forget our Facebook group).

The post Decluttering Challenge 2024 appeared first on Embracing Homemaking.

Tips for Buying a New Home – Part 1

It feels like yesterday that I sent my husband an email with a Zillow link saying, “this house is huge but hideous.” Truth is, that was nine years ago! Time flies when you’re doing remodel projects and living life. My husband bought the first home we lived in but the second was a joint decision and the first home I had ever had a part in purchasing. It was a great deal on a fixer upper and while it’s still not perfect by any means, I love it to pieces. If you’re thinking of buying a new home, here are a few tips to help you know where to begin.

1. Start saving right away.

When calculating how much money you need to buy a house you’ll want to consider the expenses like the down payment, closing costs, and also moving expenses. I didn’t realize the budget for a local move would be so much. It was probably $1,000 just for the boxes, wrapping paper and plastic wrap, tape, moving truck, and other items needed. We had a lot of friends volunteer and help us move and without that it would be even more expensive. Cross state moves would be even more expensive. You’ll also want to plan ahead for any home repairs you’ll want to do right away or any furniture you’ll need to buy. Of course, some items can wait but if they’re essential, you’ll want to add them to your list of expenses.

2. Decide how much home you can afford.

This is a hard one to judge by yourself so a house affordability calculator might come in handy. They will help you settle on a price range based on your income, debt, down payment, credit score, and where you plan to live. I remember when we were doing this and we had to be honest about what we could pay monthly. It’s easy to plan to scrimp and save to have the house of your dreams and that may be feasible for a few months but it would get old quickly. It’s good to have some buffer room when it comes to finances, at least that’s my opinion anyway. I’m not a financial expert, just a mom sharing her experience.

3. Check your credit and brush it up if necessary.

Mortgage lenders will use your credit score to base what interest rates they’ll offer you. The higher the score, the lower the interest rate. People have written extensively about how to raise your credit score so I won’t elaborate on that here. I will link here to a quick overview on how to raise your credit score.

4. Explore mortgage options.

A variety of mortgages are available with different eligibility requirements.

- Conventional mortgages are the most common type of home loan and are not guaranteed by the government. Some conventional loans targeted at first-time buyers require as little as 3% down.

- FHA loans are insured by the Federal Housing Administration and allow down payments as low as 3.5%.

- USDA loans are guaranteed by the U.S. Department of Agriculture. These are for suburban and rural home buyers and usually require no down payment.

- VA loans are guaranteed by the Department of Veterans Affairs. These are for current military service members and veterans and usually require no down payment.

You can also choose to get a 30 year term or 15 year term mortgage. Most home buyers opt for a 30-year fixed-rate mortgage. This means that they have 30 years to pay it off and the interest rate stays the same. A 15- year loan typically has a lower interest rate than the 30-year one but the monthly payments are larger. When you can, always opt for the 15 year.

I hope you’ll come back for the rest of this series to learn more about mortgage selection tips, what to have your home inspected for, and other home shopping tips to consider before making an offer.

The post Tips for Buying a New Home – Part 1 appeared first on Embracing Homemaking.

Things I Love

Years and years ago I had a series on my blog called Things I Love. There I would list things I’ve been enjoying whether it was a product you could buy, a service to use, or just a view in my home that I was currently loving. When I started posting those same things on Instagram I felt that I was being redundant and called it quits. However, since I haven’t written on my blog in quite some time I think it’s a good way to come back. Sharing things I love comes easy and I think it will be a nice way to dip my toes in the water. I hope you agree. Without further ado…

(Some of the links below include my referral links but that’s not why they were chosen.)

For years I’ve wished a company would come up with a refillable flossing container. I’m a big proponent of good dental hygiene so my family goes through a lot of floss. Tossing plastic containers wasn’t a good feeling. Every few years I would search the internet for a refillable option and I was so excited to have found one this year. The little glass container has an adorable little panda on the front too. How sweet! The bamboo charcoal floss is far better than my regular drug store brand too. It feels like it actually scrubs my teeth and doesn’t just pass over the filth. I stuck with standard Mint but they also have Coffee, Coconut, Banana, Unflavored, Strawberry, and Vanilla flavors as well. This is a great alternative to the disposable plastic containers….just make sure you don’t throw away the glass bottle. We may have done that once.  Old habits die hard sometimes. You can find the Boonboo Dental floss here on Amazon. Old habits die hard sometimes. You can find the Boonboo Dental floss here on Amazon.

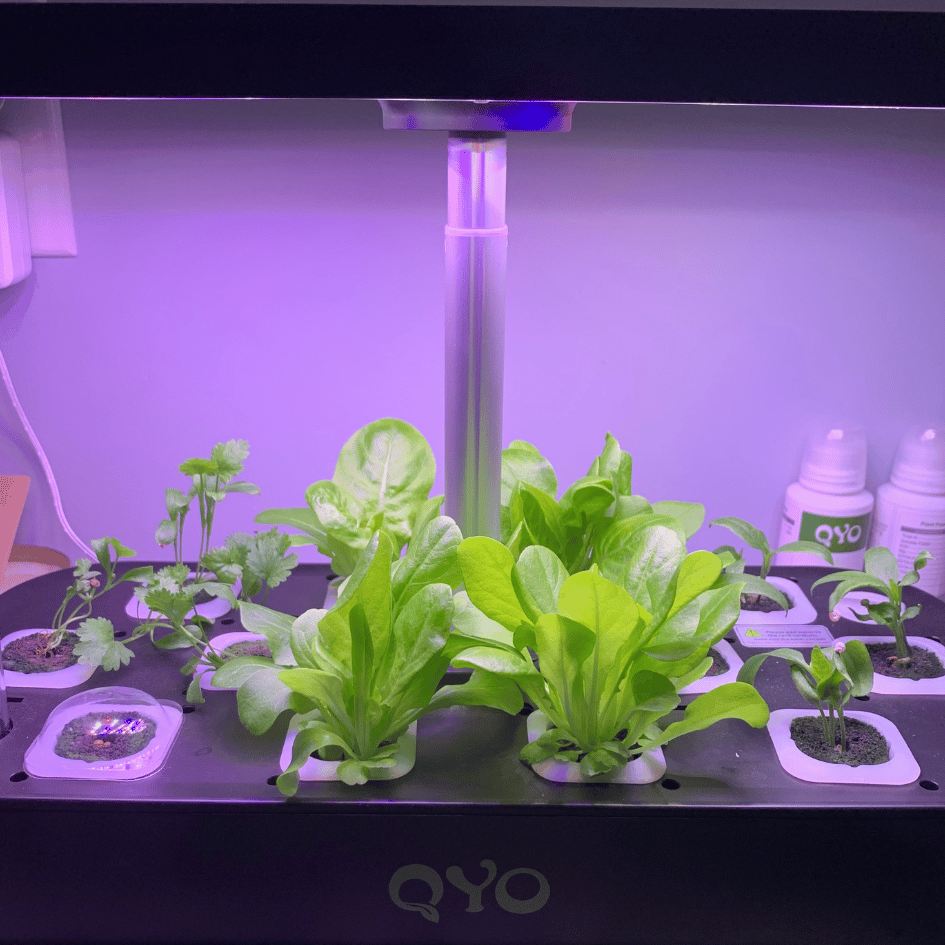

My parents gave me their hydroponics growing system for my birthday and our family has fallen in love with it. We loved watching the different seeds sprout and the little plants grow. Now we love to have fresh lettuce, basil, and cilantro any time we want it. It’s the perfect way to grow herbs and plants without having a green thumb. You just follow the directions to mix the formula with water and add it to the base once a week. It’s incredible and I can’t believe I don’t hear more people talking about them. Amazon has the set I do on sale for less than $50 right now. Click here to check it out.

I’ve been keeping my days busy with homeschooling and trying to maximize my time during the day. At night, though, I just need to crash. I love to play mindless games on my computer as a way to unwind…usually while there is a TV show on in the background. My husband says they’re not mindless and maybe they’re not but they use my brain in a different way that’s relaxing. Solitare.org is an ad free platform that has my favorite online games. They have solitaire, of course, plus chess, sudoku, gin rummy, tetra blocks (see my best score above), and so many more. I’m excited to learn how to play Mahjong through this website. If you’re looking for a relaxing way to unwind in the evening, I highly recommend this website. They also have an ad free app that’s nice but trust me, it’s so much more satisfying to quickly punch the keys on the computer than it is to tap the screen on your phone.

I probably shouldn’t sing the praises of this one too much because I just ordered it today but I’m so excited about it. It’s a book caddy that has a built in timer on the side. Today, it’s only $27 on Amazon! A visual timer alone is usually $20. I think this will be great for my son to keep the books he’s currently reading neatly by his bed. He could even use the timer to help him know when to go to bed. I think my daughter will love one for her school books. She can gather the ones she’ll be using for the day and then tote them around wherever she wants to go and keep track of her time. If she wants to read on the porch, that’s fine. If she wants to do it on the swing in the backyard, why not? This tote will keep the books safe from the ground. My friend bought one to use to keep her seasonal books out and on display. If you think you’ll love it too, go check it out here on Amazon.

Those are the four things I’m loving today. What is something that has you excited about recently? I’d love to hear! Oh, and feel free to follow me on Instagram (@EmbracingBeauty) where I share a little bit of my life every day. I hope you’ll follow there so we can connect.

The post Things I Love appeared first on Embracing Homemaking.

|

|